Share Your Position on Illinois Progress Tax

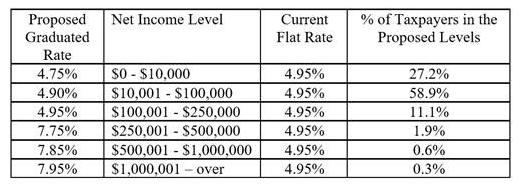

The Illinois Farm Bureau has issued a state-wide Action Alert opposing SJRCA 1, the effort to establish a progressive income tax in Illinois. This legislation proposes to amend the State Constitution to mandate a progressive tax structure; it does currently specify a tax rate but the Governor's proposal is to create six different levels of income tax rates between 4.75% and 7.95%, as follows:

If you would like to express your position on this legislation to your State Senator, call 888.200.3794. You will then be asked to enter your zip code, and your call will be directed to your State Senator's District Office. The key points for opposing this legislation are:

1. We support a flat state income tax;

2. Taxpayers who have higher incomes already pay more based on their income;

3. Separate, graduated tax levels may lead to future tax increases on various sectors of taxpayers;

4. It sends yet another message that Illinois is not a business-friendly state.

If you have questions about this legislative call to action, please contact KJ Johnson: kj@ifca.com or call our office.