International Food Policy Research Institute Releases New Report on "World Markets Prices for Food and Fertilizer"

The International Food Policy Research Institute released a new report this week on “World market prices for both food and fertilizer". IFPRI discusses the increased fertilizer prices over the past year and a half and have climbed to even higher levels following Russia’s invasion of Ukraine in February, hitting their highest levels yet in March. T (+125% from January 2021 to January 2022, +17% from January 2022 to March 2022). While there is an immediate concern about the impact of high food prices on food security, fertilizer price spikes and concerns about availability.

All these problems have been amplified by these factors:

All these problems have been amplified by these factors:

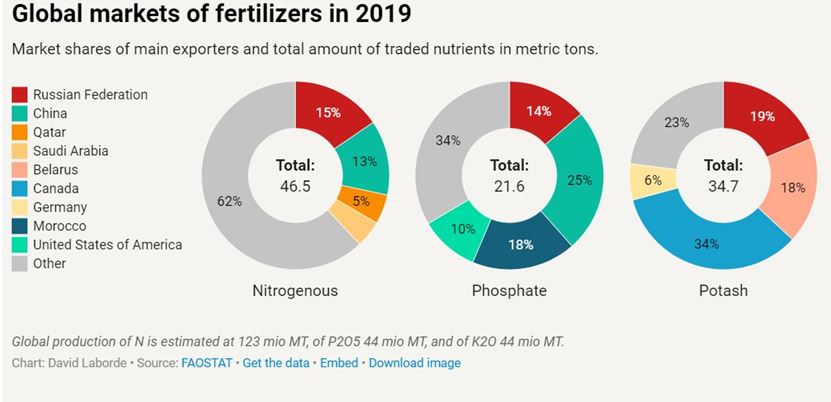

- A large amount of fertilizer—38% of all N, 50% of all P and 80% of all K produced—is traded on international markets, and the lion’s share of that trade derives from only a few countries.

- Since ammonia, the key ingredient in N fertilizers, is primarily produced using gas or coal as feedstocks, many countries could in theory manufacture them, but comparative advantage lies with countries with relatively lower gas or coal prices: In 2019, Russia, China, and Qatar together accounted for 33% (15%, 13% and 5% respectively) of N traded.

- The production of potash and phosphates is more concentrated due to the uneven distribution of source deposits:

- For phosphates, the top three exporters China, Morocco, and Russia represent 57% of global trade (25%, 18%, and 14% respectively).

- The Potash market share of the top three reaches 80% (Canada: 39%, Russia 21%, and Belarus 20%).

- The role of Russia on N, P and K markets, in conjunction with Belarus for potash, is particularly important in this current crisis